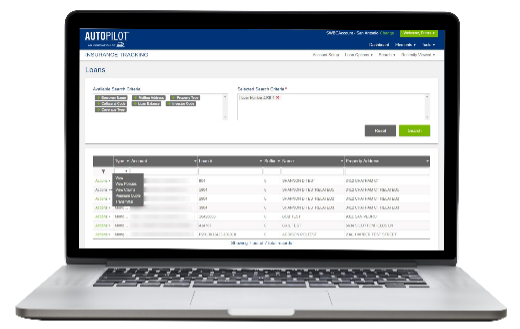

Both CPI programs are powered by our AutoPilot software, which helps to streamline your processes in a single, user-friendly platform. The mobile-friendly AutoPilot web portal is a powerful tool that allows you to modify borrower information, generate quotes, and review letters.

AutoPilot can generate institution-wide reporting, giving your financial institution’s leaders opportunities to spot trends and optimize your program throughout execution.

Learn more about our AutoPilot Risk Management Platform.